Selling a house with foundation problems can be a huge headache. Potential buyers worry about hidden damage and costly repairs. Home inspections make these issues even harder to ignore for sellers.

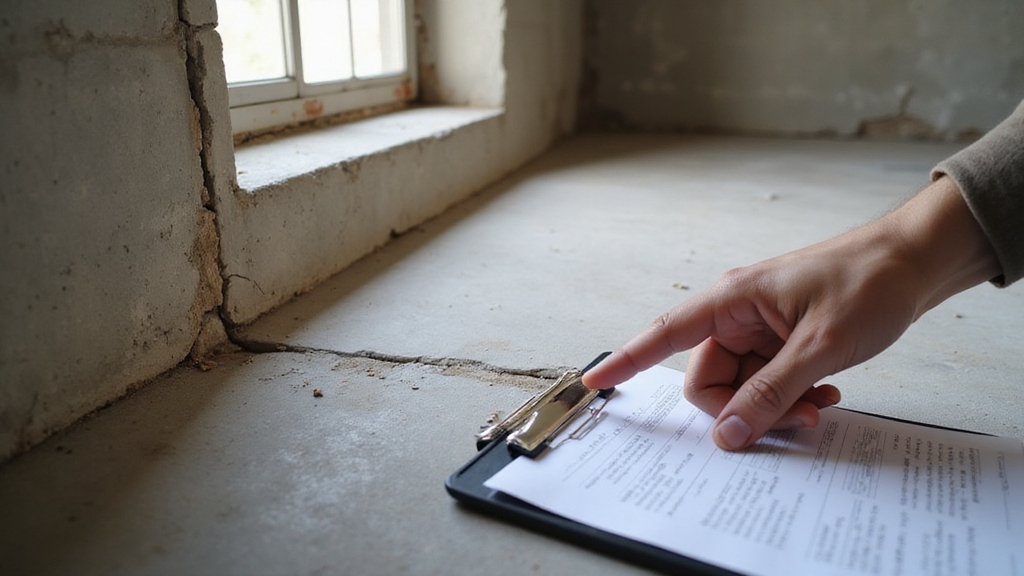

When a home inspector checks your house, every crack and shift gets noticed and reported. These findings often scare buyers away or push them to demand big discounts.

Sellers may also face legal risks if they fail to disclose known issues. Home inspections often lower your home’s value and complicate the selling process when foundation problems exist. The good news is that you can take steps to handle these challenges.

Knowing what to expect helps you make smart decisions and protect your interests. This blog will guide you through selling your home with foundation issues and help you avoid costly mistakes.

Key Takeaways

- Home inspections reveal the true extent of foundation problems, informing both sellers and buyers about needed repairs and risks.

- Inspection reports provide detailed documentation that supports mandatory legal disclosures, helping sellers avoid lawsuits and compliance issues.

- Uncovered foundation issues often lead to buyer requests for repairs, price reductions, or may deter some buyers entirely.

- Transparent sharing of inspection findings and repair histories builds buyer trust and confidence during negotiations.

- Lenders and appraisers use inspection results to determine property value and financing eligibility, directly affecting saleability.

The Role of Home Inspections in Real Estate Transactions

Home inspections are important in real estate transactions because they show the true condition of a property. An inspection gives buyers a clear report on the home’s structure and systems. If sellers understand this, they can prepare for buyer questions and concerns.

A licensed inspector looks at key parts of the house, such as the foundation, to find any problems. If they find issues, sellers might need to fix them or accept a lower price. Unfixed foundation problems often cause delays or price drops. Understanding the probate process can also impact how quickly a property can be sold if issues are discovered during inspection.

If you have done repairs, sharing inspection reports or receipts can build buyer trust. Sellers who disclose recent work may avoid surprises during negotiations. This can help the sale go smoothly and could lead to better offers. Understanding home inspection processes can also help sellers decide whether to sell as-is or invest in repairs beforehand.

Common Foundation Problems Identified During Inspections

Inspectors often find cracks in walls or floors when checking a home’s foundation. Uneven settling, water leaks, and shifting are also common problems. These issues can show the foundation needs repairs. A thorough title search can reveal hidden issues or disputes affecting the property’s ownership and condition.

Foundation problems often come from poor soil or clay under the house. Many of these issues can be identified early with proper home inspections, which can prevent costly repairs later. Buyers notice these issues because they can lower the home’s value. If you fix these problems early, your home may sell faster and for a better price.

Signs of Foundation Issues Inspectors Look For

When an inspector assesses your property, they’ll closely examine visible wall cracks and uneven floor surfaces, both key indicators of foundational movement. These red flags often signal underlying structural concerns that can impact a home’s marketability and value. Recognizing these early allows you to address issues proactively before listing.

Additionally, neglecting home repairs can lead to more serious problems down the line and potentially lower offers from buyers. Being aware of the location/land and how foundation issues may affect the property’s appeal in prime areas can also influence valuation.

Visible Wall Cracks

Wall cracks are often signs of deeper structural issues in a home. Inspectors look closely at the size, shape, and location of each crack. Serious cracks can affect your home’s safety and value.

Horizontal, stair-step, or wide vertical cracks may point to foundation problems. Inspectors pay extra attention to cracks near windows, doors, or corners. If cracks are large or spreading, buyers may worry about costly repairs.

Minor hairline cracks are common and usually not a concern. Inspectors will explain the difference between small cracks and those that need repairs. If you fix major cracks before selling, you can build trust with buyers.

Uneven Floor Surfaces

Uneven floor surfaces often show there are problems with a home’s foundation. Inspectors look for sloping, sagging, or bouncy floors during their checks. These issues point to possible structural movement.

Sloping floors are measured with a laser level. Bouncy surfaces may prompt inspectors to use a moisture meter. Gaps under baseboards are checked visually.

Loose tiles sometimes show up when floors shift. Tile movement detectors help inspectors confirm this. Squeaky floorboards are examined with a floor joist probe.

Any of these symptoms could lower buyer offers or cause repair negotiations. If inspectors find them, sellers might need to make repairs or give disclosures. Market value and buyer confidence can be affected if floors are uneven.

How Inspectors Evaluate Foundation Severity

Inspectors check foundation severity by following a clear process. They look for signs of damage and measure how much the foundation has shifted. If they find serious problems, they note how urgent repairs are.

Inspectors begin with a visual check for cracks, bowed walls, or moved bricks. They use tools like laser levels to see if floors are sloping. If floors are uneven, this could mean the foundation has moved. They also analyze public records to identify recent property changes that could indicate foundation issues, especially in areas prone to soil movement.

They also look at the soil under and around the house. If the soil is loose or holds water, it can hurt the foundation. Inspectors check if water drains away properly from the home. Proper drainage is essential for maintaining foundation stability.

If they see issues, inspectors explain which repairs matter most. Their report lists the problems, causes, and possible fixes. This helps you plan repairs or talk to buyers if you are selling.

Impact of Foundation Problems on Property Value

Foundation problems usually lower a property’s value. Buyers see foundation issues as expensive to fix and risky in the future. If inspectors find serious problems, the price may need to drop. Market conditions can influence how much a foundation issue impacts the property’s worth, with a seller’s market potentially offering more flexibility. Neighborhood comps can help determine how much value is affected by such issues.

Properties with unresolved foundation issues attract fewer buyers. These homes often stay on the market longer. Lenders may also refuse loans for homes with structural defects. Sellers should understand how foundation problems affect value. If you know the impact, you can set realistic prices. This knowledge also helps you negotiate better during the sale.

Disclosure Requirements for Foundation Issues

Legal obligations require you to tell buyers about any known foundation issues when selling your home. You must share details about past repairs and any structural inspections. If you fail to disclose problems, you could face lawsuits or lose the sale.

Most states require you to provide written records of the foundation’s condition. If repairs were made, you need to show receipts and warranties. Proper paperwork keeps the selling process honest and clear. Termite damage can sometimes mimic foundation problems, so accurate disclosure is crucial. Understanding the market conditions and how they affect property values helps sellers provide comprehensive disclosures.

If you choose to hide or change facts about the foundation, the contract may be canceled. You could also face legal trouble. Being open about repairs and inspections helps build trust with buyers.

Following disclosure rules makes the sale smoother for everyone. It also lowers the chance of arguments during the sale process. Complying with the law protects both you and the buyer.

Negotiating Repairs After an Inspection

After an inspection finds foundation problems, buyers often ask for repairs or a price reduction. Sellers should respond with clear facts and recent assessments. This helps everyone understand how serious the issue is.

If the report suggests foundation work, get quotes from licensed contractors. These quotes can support your position during negotiations. Sharing past repair records or engineering reports adds trust.

Offering a repair credit or lowering the price can speed up the sale. Market data shows that fixing foundation issues early helps keep the sale price higher. Using professional assessments builds your credibility and reassures the buyer. Proper documentation, such as records of inherited property, can also help in demonstrating the history and status of the property’s ownership.

Being aware of liens on property and ensuring they are addressed beforehand can prevent delays in closing and strengthen your position during negotiations.

How Buyers React to Foundation Findings

When a home inspection uncovers foundation issues, you’ll notice the negotiation advantage often shifts toward the buyer, as structural integrity directly impacts property value and lender approval. Buyers scrutinize your transparency and the thoroughness of your disclosure, weighing their willingness to proceed or renegotiate terms.

In this market, trust and clear communication about foundation findings are crucial for maintaining buyer confidence. Additionally, understanding how selling to a cash buyer can streamline the process may help alleviate some of the concerns related to foundation problems.

Negotiation Leverage Shifts

A home inspection can change who has more power in a negotiation. If foundation problems are found, the buyer gets more control. These issues make buyers cautious and give them reasons to ask for concessions.

Buyers may request a lower price, credits, or repairs before closing. The buyer’s agent will use the inspection report to support these requests. If there are many homes for sale, unresolved foundation issues can scare away other buyers.

Sellers risk losing offers if they refuse to address the problems. Buyers may walk away if the seller does not agree to their terms. Foundation problems often make it harder for sellers to negotiate strongly.

Trust in Disclosure

Buyers often judge a seller’s honesty based on how they disclose foundation problems. Clear and complete disclosure builds buyer trust. If a seller hides or downplays issues, buyers may lose confidence.

Buyers look for detailed records and honest answers about the foundation. If sellers provide repair histories and reports, buyers feel more secure. When details are missing, buyers may ask more questions or walk away.

If a seller shares all information, buyers usually keep negotiating. If only some facts are shared, buyers may doubt the seller. No disclosure can cause buyers to end the deal.

If sellers offer technical documents, buyers can trust the property more. Precise paperwork makes buyers feel the home is safe. Full transparency can help the sale go smoothly.

Repair Options and Their Effect on the Sale

Repairing issues before selling can help you get a better price. If you fix foundation or structural problems, buyers may feel more confident. Completed repairs may also speed up the sale. Fixing problems before selling can boost your home’s value, increase buyer confidence, and help your property sell faster.

A licensed structural engineer can tell you the best way to fix problems. Common repairs include underpinning, pier installation, or sealing cracks. If possible, keep all repair records and warranties ready for buyers.

If you choose to sell “as-is,” you may get lower offers. This option often appeals to investors, not regular buyers. Your decision to repair or not will affect how quickly and for how much your home sells.

Appraisal Challenges With Foundation Damage

When your property has foundation damage, appraisers often assign a lower value due to perceived structural risk. This reduction can trigger lender approval complications, as most mortgage providers won’t finance homes with unresolved foundation issues. You’ll need to address these concerns early to avoid stalled transactions and limited buyer interest.

Lower Appraised Property Value

Foundation problems usually lower your property’s appraised value. Appraisers look for cracks, uneven floors, and moisture issues. If they find these signs, they may lower your home’s value.

Appraisers reduce value because repairs cost money and show possible ongoing risks. Even if you have fixed the foundation, doubts can remain. Buyers and lenders may still see your home as risky.

If you have repair documents, appraisers will review them. Good records can sometimes help your value. However, foundation issues almost always cause a decrease.

Here is how different foundation issues can affect your property value:

| Issue Identified | Appraiser Action | Impact on Value |

|---|---|---|

| Visible Cracks | Value Adjustment | Decrease |

| Unstable Soil | Risk Consideration | Decrease |

| Reinforcement Needed | Cost Deduction | Decrease |

| Recent Repairs | Documentation Review | Possible Increase |

Lender Approval Complications

Lender approval can become complicated if a home has foundation damage. Lenders use the home’s value to protect their money. Foundation problems make it harder to get a mortgage.

If an inspection finds structural issues, lenders will ask for a detailed report. The report will show the damage and suggest repairs. Lenders may require these repairs before they approve the loan.

If the foundation damage is serious, the lender may lower the loan amount. Sometimes, lenders refuse to give a loan for homes with major damage. Lenders might also ask for money to be set aside for repairs.

Foundation problems can slow down the sale process. Extra inspections and repairs mean it will take longer to close. Fixing foundation issues before listing helps avoid these delays.

Selling “As-Is” Versus Making Repairs

Selling “as-is” means you do not make repairs before listing your home. This option may attract buyers looking for a discount. However, it can limit interest and lead to lower offers.

If you make repairs, start with foundation issues first. Foundation repairs build buyer trust and can help you get higher offers. Cosmetic fixes like paint or landscaping improve curb appeal but do not fix structural problems.

You should check local sales data before deciding. If repairs cost less than the value they add, they may be worthwhile. If not, an “as-is” sale might be quicker and easier.

Legal Implications of Undisclosed Foundation Defects

You’re required by law to disclose any known foundation defects, and failure to do so exposes you to significant liability. Buyers can pursue legal remedies under state buyer protection statutes, which may include rescission or financial damages. Understanding these legal frameworks is essential to mitigate risks and protect your interests during the sale.

Seller Disclosure Requirements

Full disclosure is very important when selling a home with foundation issues. The law requires you to tell buyers about major defects. This includes any known or suspected foundation problems.

A structural assessment can help you identify and document foundation issues. If you have made repairs or added reinforcements, keep all records and warranties. Buyers and inspectors will want to see these documents.

You should share assessment reports that show any weaknesses or repairs. Give details about any work done, including contractor names and warranty information. List any visible signs like cracks, uneven floors, or doors that stick.

If the home has had water leaks or soil movement, say so in writing. Honest disclosure helps build trust and avoids later problems. Clear information can also help with negotiations and protect you from legal trouble.

Potential Legal Consequences

If you do not tell buyers about known foundation problems, you may face serious legal trouble. Buyers can sue you for not sharing important facts. Courts often support buyers if they prove you hid these issues.

Sellers may lose money and damage their reputation. Legal rules require you to share all known problems with buyers. If you ignore these rules, you risk lawsuits and extra costs.

Buyers may ask the court to cancel the sale or seek money for repairs. Sellers might have to pay fines, legal fees, or more in damages. Each legal case can become long and expensive.

Buyer Protection Laws

Buyer protection laws help buyers avoid hidden foundation problems when buying a home. These rules require sellers to be honest about known issues. Sellers who do not follow these laws may face legal trouble or financial loss.

Sellers must disclose any known foundation defects. Inspection or repair records should support these disclosures. Clear documentation helps both parties understand the home’s condition.

Buyers have the right to order their own inspections. This allows them to find any hidden structural problems. Sellers cannot hide defects if buyers do their own checks.

If a seller hides foundation issues, the buyer may sue for damages. Buyers can also ask the seller to pay for repairs. Sometimes, the sale can even be canceled.

Most contracts include terms about undisclosed defects. These agreements protect buyers from unexpected problems. Sellers should be honest to avoid extra risk.

Working With Real Estate Agents on Problem Properties

Selling a problem property is easier with help from a skilled real estate agent. An experienced agent knows how to handle homes with major defects or inspection problems. This support is important to solve challenges and answer questions from buyers.

The agent can read structural reports and explain needed repairs, like foundation fixes, to buyers. They will help you meet all disclosure rules and set a fair price based on the home’s condition. If the home needs work, the agent can provide contacts for repair quotes and needed paperwork.

A specialist in distressed properties will also help you avoid legal trouble. The agent will guide you through marketing, negotiations, and closing the sale. With the right agent, you have a better chance of selling even with inspection issues.

Tips for Preparing a House With Foundation Issues for Sale

Selling a house with foundation issues needs careful preparation. Homeowners must be honest and use smart marketing to attract buyers. These steps help build trust and reduce buyer worries.

Sellers should always share all foundation repair reports and warranties. This transparency reassures buyers if they are concerned about structural problems. Clear documents can help answer questions during negotiations.

If the house has noticeable flaws, staging can draw attention to its best features. Well-arranged rooms make the home feel inviting and useful. Buyers may overlook minor issues if the property looks well cared for.

Minor cosmetic repairs can improve the home’s appearance. A fresh coat of paint or tidy landscaping can create a positive first impression. Buyers may be more willing to consider a home that looks move-in ready.

Some buyers, such as investors or those with cash, are less worried about foundation problems. Marketing to these groups can increase your chances of a quick sale. Targeted ads and clear property descriptions will help attract the right audience.

Conclusion

If you plan to sell a house with foundation problems, a home inspection is a critical step. It helps you understand the extent of the issues and prepares you for negotiations. If you address inspection findings openly, you can avoid legal troubles.

If you work with professionals and document repairs, you may preserve your home’s value. Some buyers might still hesitate, but cash buyers offer a solution. If you need to sell quickly, consider companies that buy houses for cash.

If you want a hassle-free sale, we at Limitless Homes of KC can help. We buy houses for cash in any condition. Contact us today to get started.