Selling a house with a reverse mortgage can feel confusing, especially if you’re unsure how the loan is repaid or whether the lender can block the sale. Many homeowners and heirs worry that a reverse mortgage limits their options or forces a foreclosure if the home is sold.

The good news is yes, you can sell a house with a reverse mortgage in Smithville, Missouri. However, the reverse mortgage balance must be paid in full at closing, and the sale must follow specific federal and lender guidelines.

This guide explains exactly how selling a home with a reverse mortgage works, what rules apply in Missouri, and how cash buyers can simplify the process when timelines or property condition are concerns.

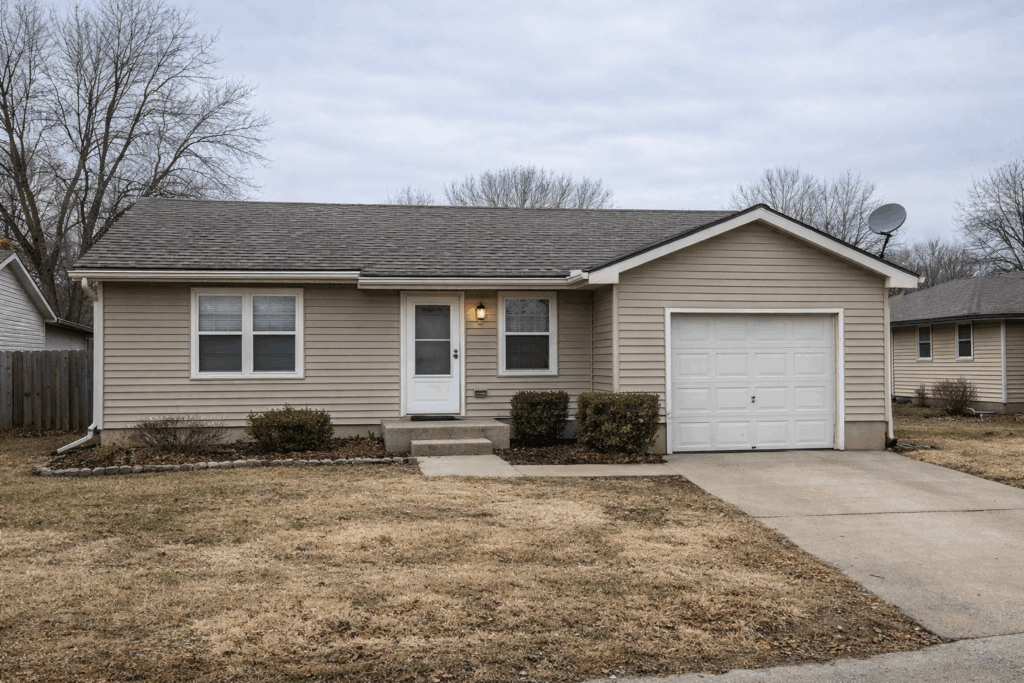

Single-family home in Smithville, Missouri

Key Takeaways

* You can legally sell a house with a reverse mortgage at any time

* The reverse mortgage loan must be repaid in full when the home is sold

* FHA-insured HECM loans protect sellers from owing more than the home’s value

* Heirs typically have limited time to sell after the borrower passes away

* Title companies handle reverse mortgage payoffs directly at closing

* Cash buyers often simplify reverse mortgage sales by avoiding financing delays

* Selling as-is is allowed, even if the home needs repairs

How Does a Reverse Mortgage Affect Selling Your Home?

A reverse mortgage is different from a traditional mortgage. Instead of making monthly payments, the loan balance increases over time as interest accrues. When the home is sold, the outstanding balance becomes due immediately.

For homeowners in Smithville, selling a home with a reverse mortgage does not require special court approval, but it does require coordination with the lender and title company to ensure the payoff is handled correctly.

What Happens When You Sell?

When you sell a house with a reverse mortgage:

- The lender issues a payoff statement

- The loan is paid off from sale proceeds

- Any remaining equity belongs to the seller or heirs

If the home sells for more than the loan balance, the seller keeps the difference. If the home sells for less, FHA insurance typically covers the shortfall on qualifying loans.

Understanding FHA-Insured Reverse Mortgages (HECM Loans)

Most reverse mortgages are Home Equity Conversion Mortgages (HECMs), which are federally insured by the FHA.

HECM loans include important protections:

- You or your heirs will never owe more than the home’s appraised value

- The lender cannot pursue other assets to collect a deficiency

- The property can be sold even if the loan balance exceeds market value

These protections are critical for Smithville homeowners who are concerned about declining property values or deferred maintenance.

When Does a Reverse Mortgage Become Due?

A reverse mortgage becomes due when one of the following occurs:

- The homeowner sells the property

- The homeowner permanently moves out

- The homeowner passes away

For heirs, this often creates urgency. Lenders typically allow a limited period to either repay the loan, refinance, or sell the home. Missing deadlines can trigger foreclosure proceedings.

Selling a House With a Reverse Mortgage After the Owner Passes Away

Heirs in Smithville, MO frequently encounter reverse mortgages when handling inherited properties.

Options for Heirs Include:

- Selling the home and using proceeds to repay the loan

- Paying off the balance and keeping the property

- Selling the home for 95% of appraised value if underwater (HECM rule)

If multiple heirs are involved, coordination becomes even more important. Title companies verify authority to sell and ensure loan payoff compliance before closing.

Do You Have to Make Repairs Before Selling?

No. Reverse mortgage rules do not require repairs before selling.

However, traditional buyers using financing may:

- Demand inspections

- Request repairs

- Back out due to condition issues

This is why many Smithville homeowners choose cash buyers, who purchase homes as-is and avoid lender repair requirements.

How the Closing Process Works With a Reverse Mortgage

Selling a house with a reverse mortgage follows a structured closing process:

- Title Search

The title company identifies the reverse mortgage and confirms lender details. - Payoff Request

A payoff statement is ordered from the reverse mortgage servicer. - Sale Proceeds Distribution

The reverse mortgage is paid first from closing funds. - Lien Release

The lender files a satisfaction removing the lien from the title. - Seller Receives Remaining Funds

Any remaining equity is disbursed to the seller or heirs.

Title companies manage this process to ensure compliance with Missouri real estate regulations.

What If the Reverse Mortgage Balance Is Higher Than the Home’s Value?

If the home is worth less than the loan balance:

- FHA insurance covers the difference

- The seller or heirs are not personally liable

- The lender cannot pursue additional assets

This protection makes selling possible even in declining markets or when the property needs extensive repairs.

Why Many Smithville Homeowners Choose Cash Buyers

Cash buyers simplify reverse mortgage sales by:

- Eliminating financing delays

- Avoiding inspection-related complications

- Closing within lender deadlines

- Purchasing homes in as-is condition

Speed matters when reverse mortgage timelines are involved. Missed deadlines can lead to foreclosure even when selling is an option.

Selling a House With a Reverse Mortgage in Smithville

Selling a house with a reverse mortgage in Smithville is absolutely possible, but it requires understanding the rules, timelines, and payoff process. Whether you’re a homeowner planning ahead or an heir managing an inherited property, knowing your options helps you avoid costly mistakes.

Working with professionals who understand reverse mortgage transactions can make the difference between a smooth sale and unnecessary delays.

Ready to Close Fast? Limitless Homes of KC Buys Your Home Now

Limitless Homes of KC specializes in purchasing properties with judgment liens and title complications. We are cash home buyers who understand Missouri real estate laws and creditor rights. Our team handles all aspects of clearing title with judgement and satisfying legal obligations.

We serve Kansas City, Missouri, and surrounding communities including Independence, Raytown, Excelsior Springs, Missouri City, Liberty, Platte City, Smithville, and other popular areas throughout the region. Contact us today for a fair cash offer on your property, regardless of judgments or liens attached. Let us help you move forward and resolve your real estate challenges quickly.